#Chase freedom spending category review free#

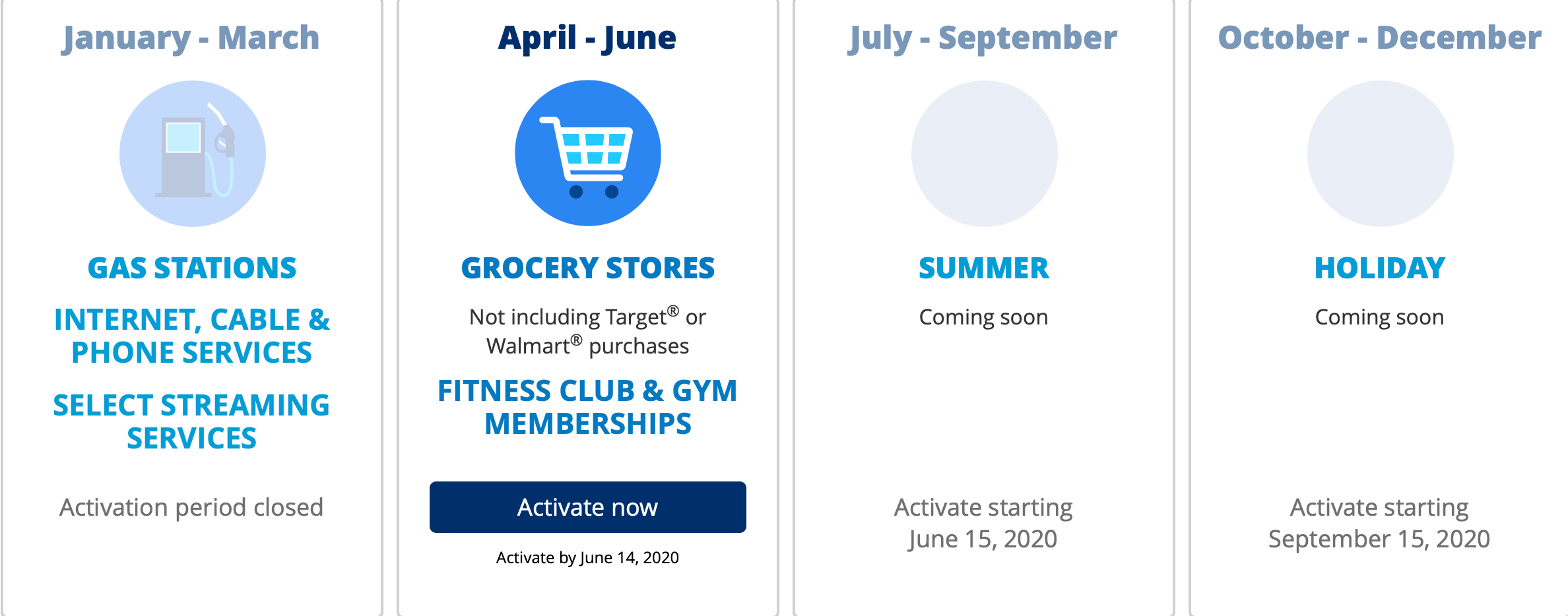

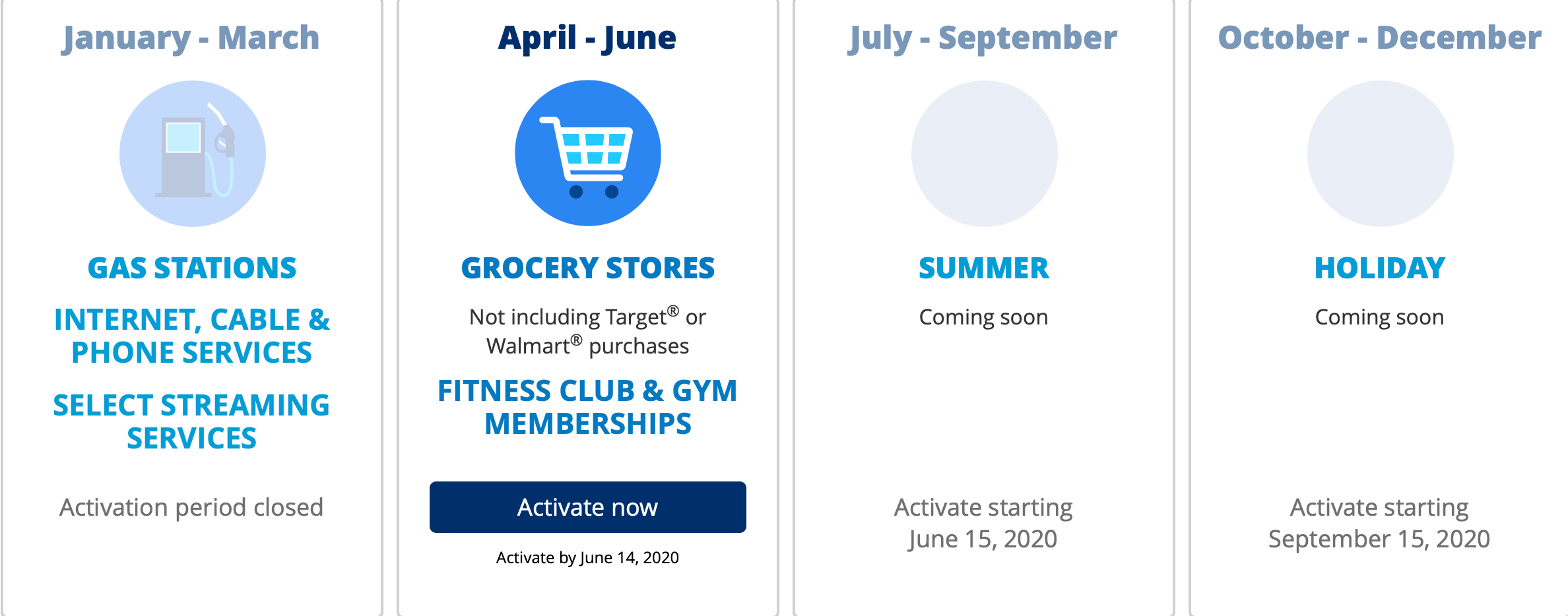

Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more. In fact, the Freedom Unlimited is my first recommendation to people just starting to dip their toes into the world of travel rewards. No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card At first glance, the Chase Freedom Unlimited seems like a tame cash-back card with a modest sign-up bonus but there’s a lot more to it than meets the eye. It offers several higher-earning cash-back categories, but its 1 cash back on all other purchases isn’t. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 19.49% - 28.24%. The Chase Freedom Flex is one of the better no-annual-fee cards available today. Cash Back rewards do not expire as long as your account is open! You can choose to receive a statement credit or direct deposit into most U.S. After your first year or $20,000 spent, enjoy 5% cash back on Chase travel purchased through Ultimate Rewards®, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. Enjoy 6.5% cash back on travel purchased through Chase Ultimate Rewards®, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!. If you're interested in applying, take a look at the top cash back credit cards. The good news is that the majority of cash back cards don't charge a yearly fee. Before you open a new card, check to see if there's an annual fee. Most cash back cards allow you to redeem cash back for statement credit. While earning is often simple, there may be a cap on how much you can earn each quarter or year. Some cards offer a set percentage of cash back on all spending, while others have earning categories. If you already use credit cards regularly, you might as well get rewarded, and cash back cards offer an easy way to earn those rewards. If you're not earning credit card rewards, you may want to start with a cash back card. Cash back credit cards offer simple ways to earn rewards You should allow up to eight weeks for your bonus cash to post to your account. Your total spending and earning will be calculated on Dec. It earns unlimited 1.5 cash back on everyday purchases. If you have the Chase Freedom Flex℠, don't forget to activate your quarterly categories, so you don't miss out on this extra cash back. Chase Freedom Unlimited is an excellent card to earn unlimited cash-back rewards on everyday spending. That's 1% base earning for purchases + 4% bonus on travel booked through the Chase Ultimate Rewards portal + 4 % bonus earning on top spending category. That adds up this way: 1% base earning for purchases + 2% earning on dining spending + 4 % bonus earning on top spending category.Īnother example: If your top spending is travel purchased through the Chase Ultimate Rewards portal, you'll earn up to 9% cash back.

For example: If your top spending is dining, you can earn up to 7% cash back.

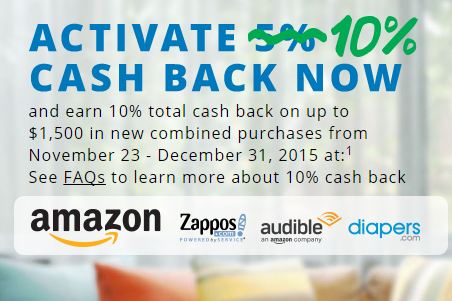

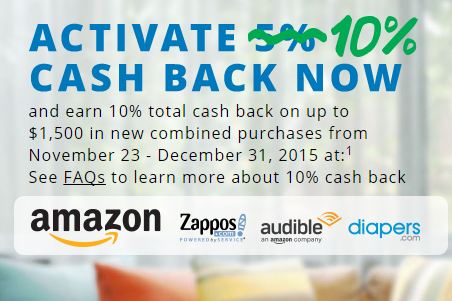

If your top spending is a category that also earns bonus cash back rewards, there's a limit to the total percentage you can earn. The 5% cash back is calculated this way: 4% additional cash back, on top of the card's usual 1% cash back on purchases. You only need to activate your quarterly categories to qualify for the top spend bonus cash back offer. Grocery stores (excluding Walmart and Target).Those who activate the fourth-quarter cash back categories will also earn 5% total cash back on up to $1,500 in the category where they spend the most from Oct. More: Save while you pay off debt with one of these top-rated balance transfer credit cardsĬhase has an additional cash back offer for Chase Freedom Flex℠ cardmembers this quarter. Save: This credit card has one of the longest intro 0% interest periods around

0 kommentar(er)

0 kommentar(er)